Rocket Lab USA, Inc.( ticker RKLB) has fleetly surfaced as a crucial player in the aerospace assiduity. Specializing in small satellite launches, Rocket Lab has developed an effective and innovative approach to space disquisition, situating itself at the van of the marketable space request. As the space assiduity continues to expand, RKLB stock has garnered significant attention from investors eager to tap into the space frugality. In this composition, we’ll claw into Rocket Lab’s business, growth prospects, and what investors need to know about RKLB stock.

Overview of Rocket Lab

innovated in 2006 by Peter Beck, Rocket Lab began with the thing of standardizing access to space by making it more affordable and accessible for businesses and governments. Headquartered in Long Beach, California, Rocket Lab designs, builds, and launches small to medium- sized loads into route. The company’s flagship product is the Electron Rocket, a small lift rocket acclimatized for planting loads of over to 300 kilograms into low Earth route( LEO).

Rocket Lab has also expanded into developing its Photon satellite platform, a completely integrated satellite result that provides end- to- end charge support for guests. This versatility has helped Rocket Lab sculpt out a niche in the satellite launch request, which has traditionally been dominated by larger players like SpaceX.

RKLB Stock A Quick Overview

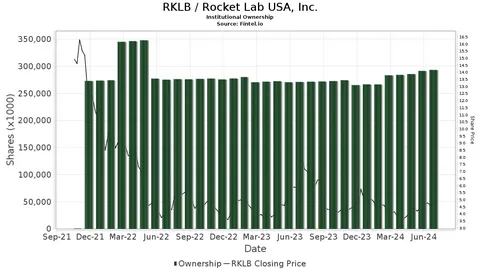

Rocket Lab went public in August 2021 through a SPAC( Special Purpose Acquisition Company) junction with Vector Acquisition Corporation. Since also, RKLB stock has attracted the attention of institutional and retail investors likewise, especially those interested in the growing space frugality. As of 2024, the stock is traded on the NASDAQ, with its performance nearly tied to the company’s capability to execute its ambitious growth strategy.

The space sector has seen increased interest in recent times, driven by growing demand for satellite- grounded services, space disquisition operations, and public security operations. Rocket Lab’s core business — launching small satellites for marketable and governmental purposes — places it at the heart of this growth.

The Growth of the Small Satellite Market

One of the primary motorists behind Rocket Lab’s success is the explosion of demand for small satellites. These satellites serve a variety of purposes, including telecommunications, Earth observation, scientific exploration, and defense. Unlike large satellites that are precious to make and launch, small satellites are more cost-effective and can be stationed in large figures to give enhanced content.

Rocket Lab’s Electron Rocket has come one of the go- to platforms for launching small satellites into space. With further than 40 successful launches as of 2023, Rocket Lab has proven its trustability and effectiveness in meeting the requirements of satellite guests. The company’s capability to launch constantly, coupled with competitive pricing, gives it an edge in the fleetly growing small satellite request.

crucial Advantages of RKLB Stock

For investors considering RKLB stock, several factors make Rocket Lab an seductive investment occasion

1. Proven Track Record

Rocket Lab has a solid track record of successful launches, which is a critical factor in the aerospace assiduity. The company has constantly delivered on its pledges, gaining the trust of guests like NASA, the U.S. Department of Defense, and private satellite companies. This trustability differentiates Rocket Lab from numerous lower space startups that have yet to achieve regular launch meter.

2. Recreating profit Model

Rocket Lab’s business model is erected on recreating profit from launch services. The company charges guests for every rocket launch, with contracts frequently secured well in advance. This provides a predictable profit sluice, particularly as the demand for satellite launches continues to grow. also, Rocket Lab has expanded into satellite manufacturing and charge services, further diversifying its profit base.

3. Expansion into Reusable Rockets

In 2020, Rocket Lab blazoned plans to develop a applicable rocket, Neutron, designed for larger loads. This marks a significant expansion beyond small satellite launches and positions Rocket Lab to contend with larger players like SpaceX in the medium- lift rocket request. The development of applicable rocket technology could reduce launch costs, making Rocket Lab indeed more competitive and charming to a wider range of guests.

4. Photon Satellite Platform

Rocket Lab’s Photon satellite platform allows guests to develop, launch, and operate their own satellites without demanding to work with multiple merchandisers. This end- to- end service model creates fresh profit aqueducts for Rocket Lab and strengthens its position as a one- stop shop for space services. Photon also supports deep- space operations, giving Rocket Lab access to unborn disquisition operations beyond Earth’s route.

5. Strategic Accessions

Rocket Lab has also expanded its capabilities through strategic accessions. For case, its accession of Sinclair Interplanetary, a satellite tackle company, enables Rocket Lab to integrate satellite factors into its immolation. These accessions not only diversify Rocket Lab’s profit but also enhance its capability to serve guests in the satellite manufacturing request.

Challenges Facing RKLB Stock

While Rocket Lab holds significant pledge, there are also pitfalls associated with investing in RKLB stock

1. Capital-ferocious Assiduity

The aerospace assiduity is notoriously capital- ferocious, and Rocket Lab is no exception. Developing rockets and satellites requires substantial outspoken investment, and the perimeters can be slim, especially for lower companies. Investors should be aware of Rocket Lab’s capability to manage its capital expenditures effectively and secure enough contracts to remain profitable.

2. Competition

Rocket Lab faces stiff competition, not only from established titans like SpaceX but also from other small satellite launch companies similar as Relativity Space and Astra. SpaceX’s Falcon 9 rocket, which has the capability to launch multiple small satellites in a single charge, is a redoubtable contender. Rocket Lab will need to continue instituting and maintaining its cost-effective, dependable service to stay competitive.

3. request Volatility

The stock request’s perception of space- related companies can be unpredictable. While there’s growing interest in the space frugality, shifts in investor sentiment can lead to significant swings in RKLB stock price. Rocket Lab’s success will depend on its capability to meet request prospects and deliver harmonious results.

4. Regulatory Environment

Space is a largely regulated assiduity, and Rocket Lab operates under strict nonsupervisory fabrics in the U.S. and internationally. Changes in government programs, especially related to public security or environmental enterprises, could impact Rocket Lab’s business. also, as further companies enter the space assiduity, the nonsupervisory geography may evolve, introducing new compliance challenges.

The Future of RKLB Stock

Rocket Lab’s future looks promising, with its combination of dependable launch services, innovative technology, and a growing client base. The continued demand for small satellite launches and the company’s expansion into satellite manufacturing and deep- space operations offer significant growth eventuality.

In the coming times, the development of the Neutron rocket and applicable technology could open new profit aqueducts and increase Rocket Lab’s competitiveness in the space request. also, as space disquisition and satellite deployment come more integral to diligence like telecommunications, defense, and environmental monitoring, Rocket Lab is well- deposited to profit from the broader space frugality.

Conclusion

For investors seeking exposure to the fleetly expanding space assiduity, RKLB stock represents a compelling occasion. Rocket Lab has demonstrated harmonious growth, invention, and trustability in its operations, making it a strong contender in the space race. still, implicit investors should be apprehensive of the challenges, including competition and capital intensity, before making any investment opinions.

With its ambitious vision and strategic focus on expanding beyond small satellite launches, Rocket Lab is a company worth watching nearly in the coming times.